Bull Markets vs. Bear Markets: Why Patience Wins for Long-Term Investors

Image from Creative Planning - @CharlieBilello

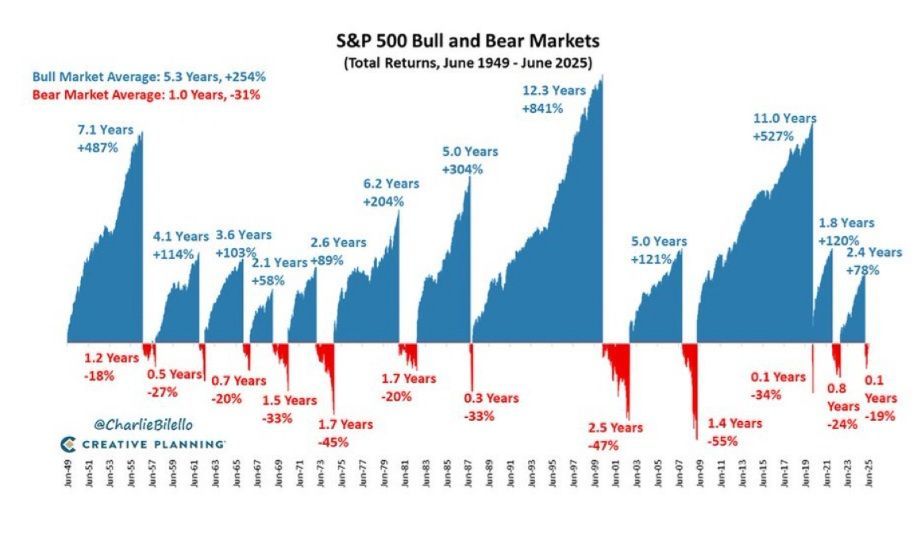

Market ups and downs are a natural part of investing, and every long-term investor will experience both bull (extended periods of rising stock prices) and bear markets (declines of 20% or more). But if you step back and look at the data over decades, one thing becomes very clear: bull markets have historically been longer and more powerful than bear markets.

A recent chart shared by Peter Mallouk on X illustrates this point perfectly. Looking at the S&P 500 from 1949 to mid-2025:

- Average bull market: Lasted 5.3 years with a total return of +254%

- Average bear market: Lasted just 1 year with a total decline of -31%

In other words, the market spends far more time climbing than falling, and the gains over time dramatically outweigh the losses.

What This Means for Your Portfolio

This is more than just an interesting historical fact. It’s a powerful reminder for investors that:

- Bear markets are temporary. They feel intense in the moment, but history shows they don’t last as long as the fear might suggest.

- Bull markets build wealth. The compounding effect of extended growth periods is what drives long-term portfolio success.

- Time in the market beats timing the market. Trying to jump in and out can mean missing the early, high-return phases of bull runs.

The Emotional Challenge

When markets fall 20%, 30%, or even 50%, it can be tempting to sell and “wait for the dust to settle.” But looking at the chart, the sharp red dips (bear markets) are consistently followed by much larger blue climbs (bull markets).

The investors who stay invested during those downturns are the ones who benefit most from the recoveries.

Why Bearish Voices Often Sound “Smarter”

If bull markets are longer and more profitable, why do bearish predictions and “perma-bears” get so much attention? A big reason lies in human psychology, loss aversion tells us that the pain of losing money feels stronger than the pleasure of making it. This bias makes investors more sensitive to warnings than to optimistic outlooks. When someone calls a downturn correctly, it stands out and makes them seem prescient, even if their long-term track record is poor.

The problem is that acting on frequent bearish calls often means sitting out large portions of bull markets, which history shows is a losing strategy over time. Fear can sound like wisdom, but for most investors, it’s a costly detour from compounding wealth.

Two common traps investors fall into when listening to persistent bearish voices are:

(1) Staying in cash for years waiting for “the big drop” that never comes, and

(2) Selling out during a downturn but failing to get back in before the recovery begins. Both behaviors can erode returns far more than simply enduring short-term market declines.

Prospera’s Perspective

At Prospera, we believe in building investment plans designed for the long term, portfolios that can weather bear markets without derailing your financial goals. That means:

- Diversifying across asset classes

- Aligning investments with your risk tolerance and time horizon

- Avoiding emotional decision-making during periods of volatility

- Keeping your focus on the big picture, not the short-term noise

The data is clear: patience and discipline are your greatest assets as an investor.

Plan Your Tranquility™ because true wealth is not about reacting to every market movement, but about having the confidence to let time and strategy work in your favor.

Have questions about your plan or how this may affect your portfolio? Talk to Prospera. We’re here to help you stay grounded, informed, and focused on what matters. www.prospera.investments

This communication is provided for informational purposes only and does not constitute investment advice, a recommendation, or an offer to buy or sell any security. Investors should consult their financial advisor to assess whether any investment is appropriate for their individual circumstances. Past performance is not indicative of future results. There are no guarantees of future returns, and all investments carry risks, including the potential loss of principal.