PROSPERITY FOUNDATION

Education

Start Here

Your prosperity journey starts with self-knowledge and education.

Blog

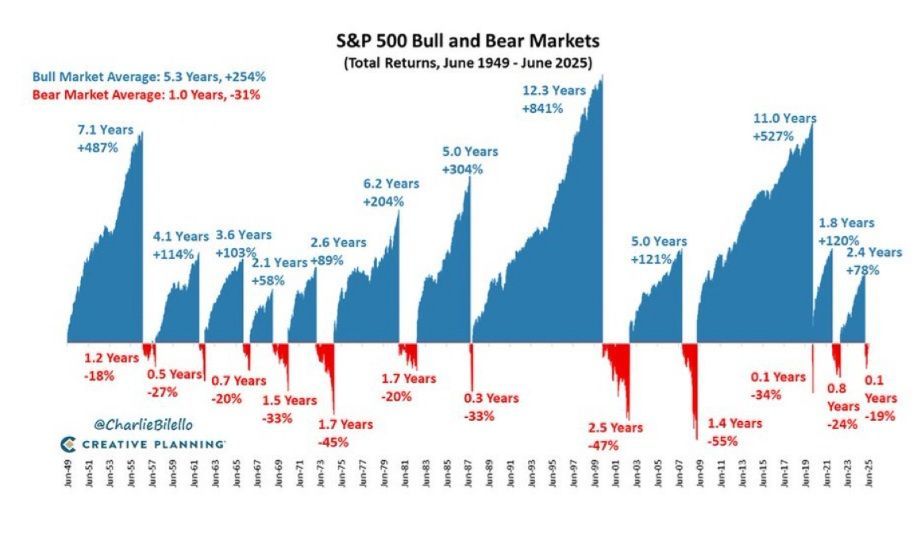

At Prospera , we believe that financial planning is as much about human behavior as it is about markets. One of the most powerful, and costly, psychological biases affecting investors is loss aversion : the tendency to feel losses more intensely than gains of the same size. This simple truth helps explain why investors panic in downturns, hold on to losing stocks for too long, or underinvest in opportunities that could build long-term prosperity. What the Research Shows The concept of loss aversion was first formalized by psychologists Daniel Kahneman and Amos Tversky in their groundbreaking work on prospect theory . Their experiments revealed that most people need a potential gain of about twice the size of a potential loss before they will take a gamble . In mathematical terms, the “loss aversion coefficient” is around 2.25: losses loom more than twice as large as gains. Other research built on these insights: Disposition effect (Shefrin & Statman, Odean): Investors tend to sell winning positions too soon, locking in small gains, and hold on to losers too long, hoping to avoid the pain of realizing a loss. Myopic loss aversion (Benartzi & Thaler): Investors who monitor their portfolios too frequently see more short-term losses, and become more risk-averse than is rational for their long-term goals. These biases aren’t just theoretical, they show up in real portfolios every day. How It Shows Up in Real Life Loss aversion can distort investment decisions in predictable ways: Bailing at the bottom: In a market selloff, fear of further losses pushes investors to sell at the worst possible time, missing out when markets recover. “I’ll sell when I get back to even”: Anchoring on the original purchase price makes investors hold poor investments longer than they should, turning a financial decision into an emotional one. Over-checking accounts: Looking at daily fluctuations magnifies the emotional sting of losses, even if the long-term trajectory is positive. Together, these behaviors reduce returns and increase stress, an unfortunate combination. Why It Happens: A Quick Tour of Prospect Theory Prospect theory helps explain why even experienced investors fall into these traps. Unlike traditional finance, which assumes people make decisions based on overall wealth, prospect theory shows that we evaluate outcomes relative to a reference point, usually where we started. Here’s the key: For gains, the curve is concave, meaning each extra dollar gained feels a little less exciting than the one before. (Finding your first $100 feels amazing; the next $100 still feels good, but not twice as good.) For losses, the curve is convex, meaning each extra dollar lost hurts, but the sting of the first loss is sharper than the second. (Losing $100 feels awful; losing another $100 still hurts, but not double.) Most importantly, the curve is steeper for losses than for gains. Losing $100 hurts more than gaining $100 feels good. This simple shape of human psychology helps explain why investors chase risk to recover losses, yet shy away from opportunities when they’re already ahead. What You Can Do About It At Prospera , we help clients counter loss aversion not by asking them to ignore their emotions, but by designing structures and processes that protect them from themselves. A few guardrails: Write it down. A formal Investment Policy Statement sets rules for risk, allocation, and rebalancing, so choices are tied to the plan, not emotions. Reframe the reference point. Look at performance at the household and long-term level, not position by position. Automate discipline. Scheduled rebalancing ensures that you systematically buy low and sell high. At Prospera , we also use systematic models that remove the need to trade based on subjective factors or emotions. This guarantees that decisions are made consistently, separating the emotional impulse from the systematic process , and ensuring that discipline wins over fear or greed. Use a bucket framework. Our Plan Your Tranquility™ approach separates safe assets for near-term needs from long-term growth capital, reducing the urge to panic during downturns. Reduce the noise. Fewer portfolio check-ins mean fewer emotional triggers, helping you stick with the strategy. Harvest losses strategically. Tax-loss harvesting turns temporary losses into potential tax benefits, turning a bias into a tool. The Bottom Line Loss aversion is deeply human, and it won’t disappear. But it can be managed. The key is not willpower, but structure: building a plan that anticipates how you’ll feel in both good times and bad, and setting up rules and systems that keep you disciplined. At Prospera , our mission is to give clients confidence through every stage of their financial journey. Plan Your Tranquility™ means structuring both portfolios and decision-making processes so that short-term emotions don’t derail long-term prosperity. Have questions about your plan or how this may affect your portfolio? Talk to Prospera . We’re here to help you stay grounded, informed, and focused on what matters. www.prospera.investments This communication is provided for informational purposes only and does not constitute investment advice, a recommendation, or an offer to buy or sell any security. Investors should consult their financial advisor to assess whether any investment is appropriate for their individual circumstances.

At Prospera , we’ve seen firsthand how even successful professionals, tech executives, entrepreneurs, and high earners, can fall into subtle traps that quietly erode their wealth. These aren’t dramatic mistakes like reckless speculation or chasing fads. Instead, they’re the quieter, more “normal” habits that, left unchecked, chip away at financial security and limit long-term potential. The truth is: earning more is only half the equation. Protecting, growing, and aligning wealth with your life goals requires avoiding the hidden pitfalls. Our Plan Your Tranquility™ framework is designed to do exactly that, help you achieve prosperity with peace of mind. Here are five silent wealth killers we see most often: 1. Overloading on Fixed Income Bonds and CDs feel safe. They provide predictable returns and a sense of stability. But for many successful professionals, leaning too heavily on fixed income is a mistake. While fixed income belongs in every portfolio, it’s designed for ballast, not for growth. If too much of your wealth is locked into bonds, you’re sacrificing compounding potential. Over decades, that “safety” can cost you hundreds of thousands, even millions, in missed growth. And in inflationary environments, fixed income can actively erode purchasing power. Prospera Insight : We position fixed income thoughtfully, but always as a complement to equities and growth assets. Your plan should balance security with long-term wealth creation. 2. Having Either Too Much (or Too Little) Cash Cash is deceptively tricky. Some people hoard it endlessly, missing opportunities, while others hold dangerously thin reserves. Both extremes can harm long-term outcomes. Without enough liquidity, every unexpected expense, job transition, home repair, health event, forces you into debt or poor-timing investment sales. With too much, inflation silently eats away at your savings, robbing you of growth. Prospera Insight : We help clients define the right level of liquidity for both resilience and opportunity, typically a healthy emergency fund plus smart planning for near-term goals. Beyond that, your cash should be put to work. 3. Only Investing for Retirement (or Not at All) Retirement accounts like 401(k)s are excellent tools, but they’re not the whole picture. Many successful professionals end up “401(k) rich, cash poor,” or worse, never build wealth outside of their paycheck at all. Life doesn’t wait until age 65. Buying a home, starting a company, taking a sabbatical, or funding your kids’ education, all require capital outside retirement vehicles. Limiting your wealth strategy only to retirement accounts (or avoiding investing entirely) leaves you underprepared for the stages of life in between. Prospera Insight : We structure wealth in buckets. Those buckets are built around risk and resilience, not just timelines. Having them in place allows you to fund life as it happens. 4. Tech Tunnel Vision This is especially common for tech professionals. You’re paid partly in stock, you understand your industry deeply, and you naturally invest in what you know: more tech . It can work well, until it doesn’t . These are the kinds of situations that can derail a whole plan because while investing in more tech may seem like the best move during bull markets, it also leads to much sharper losses in bad years and bear markets. Prospera Insight : Diversification is about protecting you from being over-exposed to the same ecosystem that already provides your income. We help you broaden your portfolio without losing the upside potential of the industry you know best. 5. Company Stock Concentration Many executives and employees accumulate a massive percentage of their net worth in employer stock, often 50% or more. It feels like betting on yourself, but it’s one of the riskiest moves you can make. One bad year, a failed product launch, or a sudden industry downturn can erase years of paper wealth overnight. Think about how many “unbeatable” companies have stumbled in just the past two decades. Prospera Insight : Wealth is often built through concentration, but it’s preserved through diversification. At Prospera , we manage systematic portfolios and plan diversification with this goal in mind, protecting your wealth for the long run. Avoiding Mistakes, Building Tranquility The encouraging part? All five of these mistakes are fixable. And none of them require drastic changes, just awareness, a structured plan, and small adjustments that compound into massive differences over time. At Prospera , we believe financial planning is about more than just numbers. It’s about building prosperity with clarity, balance, and confidence across every stage of life. Successful professionals already have the income, our role is to ensure those earnings are transformed into durable, long-lasting wealth. That’s what Plan Your Tranquility™ means: not only achieving prosperity, but doing it in a way that gives you peace of mind. Have questions about your plan or how this may affect your portfolio? Talk to Prospera . We’re here to help you stay grounded, informed, and focused on what matters. www.prospera.investments This communication is provided for informational purposes only and does not constitute investment advice, a recommendation, or an offer to buy or sell any security. Investors should consult their financial advisor to assess whether any investment is appropriate for their individual circumstances.

Give me more

Continue your journey by clicking the links bellow.