Portfolio and Asset Management: A Strategic Approach to Financial Tranquility

In the fast-paced world of tech, where innovation drives success, tech executives often build wealth through a combination of salaries, equity compensation (stock options and RSUs), and investments. However, these assets can be highly illiquid, making it difficult to access cash quickly when unexpected financial needs arise. In addition, the complexity of stock options and RSUs can lead to significant tax obligations if not managed carefully. As your career progresses, your wealth management strategy must evolve to reflect your personal goals, lifestyle, and values, ensuring your financial future remains secure rather than a source of stress.

A well-crafted financial plan aligns your resources with your personal and professional goals, ensuring that your wealth not only supports your current needs but also fuels your long-term aspirations. By strategically managing your asset allocation and integrating risk management principles, you can build a plan that provides clarity, focus, and the confidence to pursue the things that matter most in life.

The Portfolio: Balancing Risk, Return, and Purpose

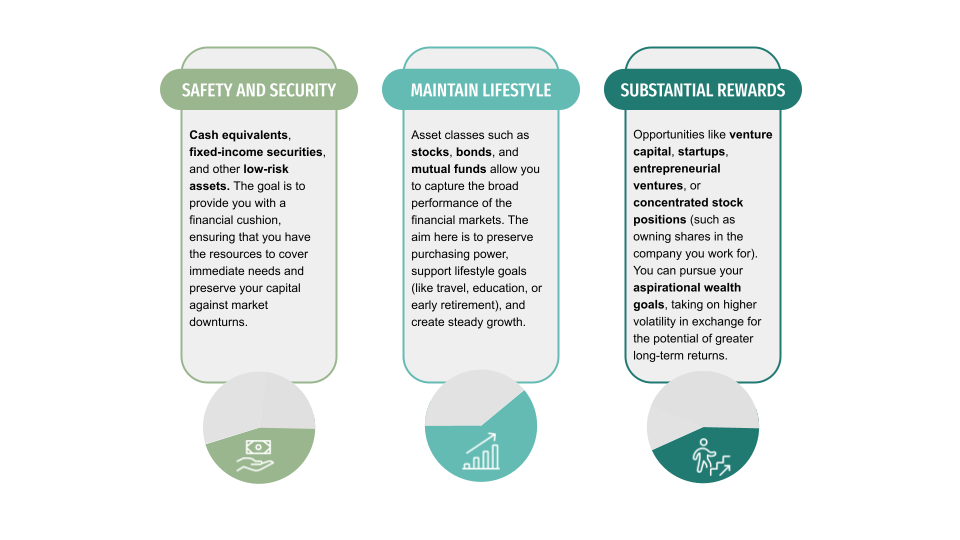

At the heart of financial planning is your

portfolio. A thoughtfully constructed asset allocation is not merely a collection of investments; it’s a strategic tool designed to support your financial goals, enhance your lifestyle, and safeguard your future. In the tech world, the wealth-building journey is often broken into distinct

investment buckets, each designed to address different objectives based on your time horizon, risk tolerance, and aspirations.

Optimizing Liquidity and Taxes: A Holistic Approach to Asset Management

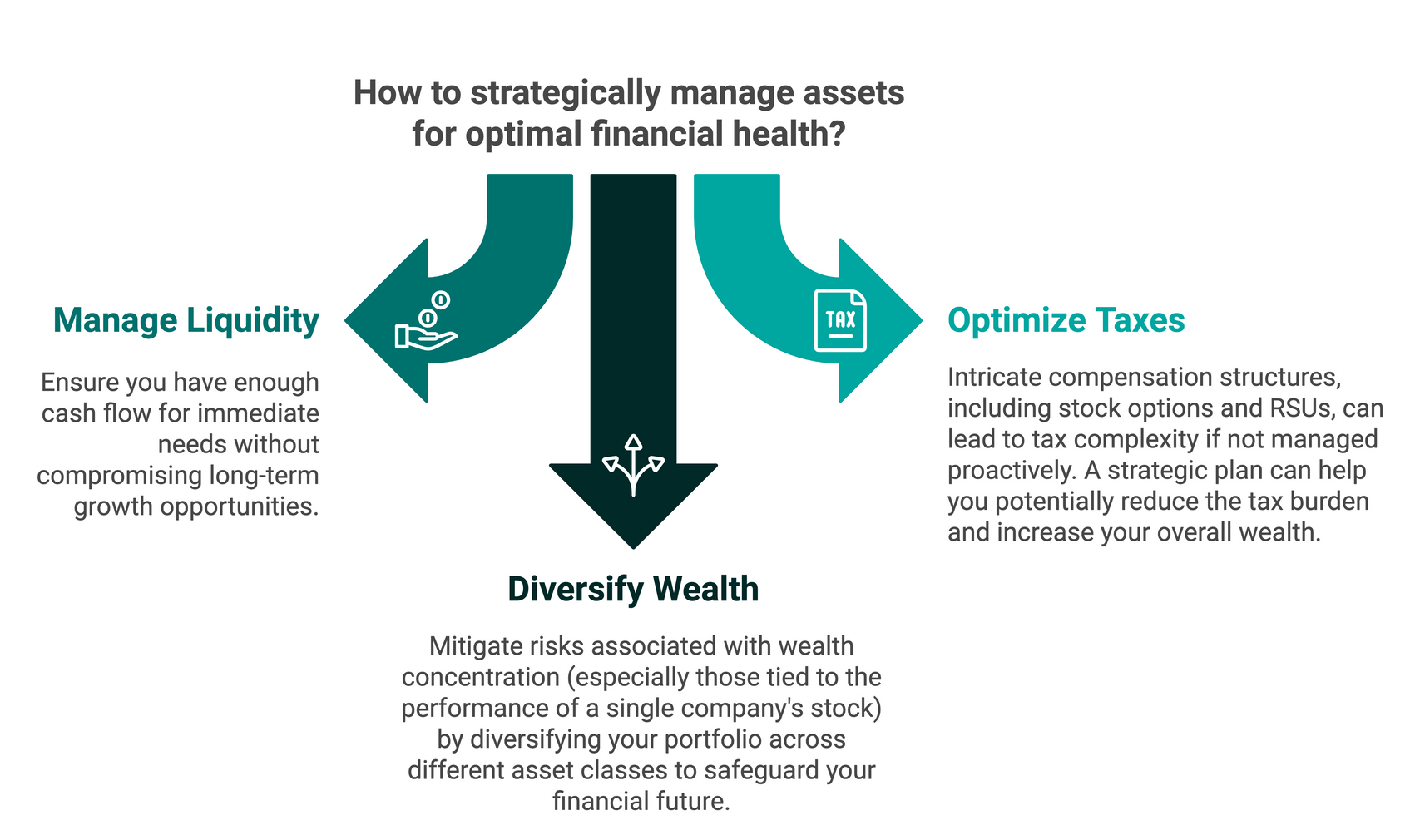

A comprehensive financial plan is about more than just selecting the right investments. It involves

strategically structuring your assets to balance

liquidity,

tax obligations, and

long-term growth.

The Path Forward: Tailored Asset Management

Your financial plan should reflect not only your wealth-building strategies but also your personal aspirations. By aligning your investments with your life goals, you are actively shaping a future that supports both your financial well-being and your personal passions. Whether your focus is on securing your family’s future, maintaining your lifestyle, or creating wealth through specific opportunities, a balanced and well-structured portfolio is essential.

At Prospera, we understand the unique challenges that tech executives face when it comes to managing wealth. We are here to help you navigate the complexities of asset management, tax strategies, and investment diversification, offering personalized solutions that align with your goals.

With a clear financial plan and a dedicated approach to portfolio management, you can focus on what truly matters: achieving your personal and professional dreams while enjoying continuous tranquility.

Plan your Tranquility with Prospera.