Continuous Tranquility: Your journey to enjoy life

What does tranquility mean to you? Is it the peace of mind that comes from knowing your future is secure, the freedom to pursue your passions, or the assurance of financial stability for your family?

As a tech executive, you are no stranger to the unique challenges of navigating both innovation and financial security. Yet, as many tech leaders, you find yourself struggling with:

Also, issues like wealth concentration, liquidity constraints, limited understanding about the complexities of financial strategies, compensation structures and the challenges of self-managing investments can jeopardize your stability.

Why not prioritize your tranquility with the same dedication you apply to your career? Your peace of mind is just as crucial as your professional success, and aligning your financial planning with your life purpose is key to achieving it.

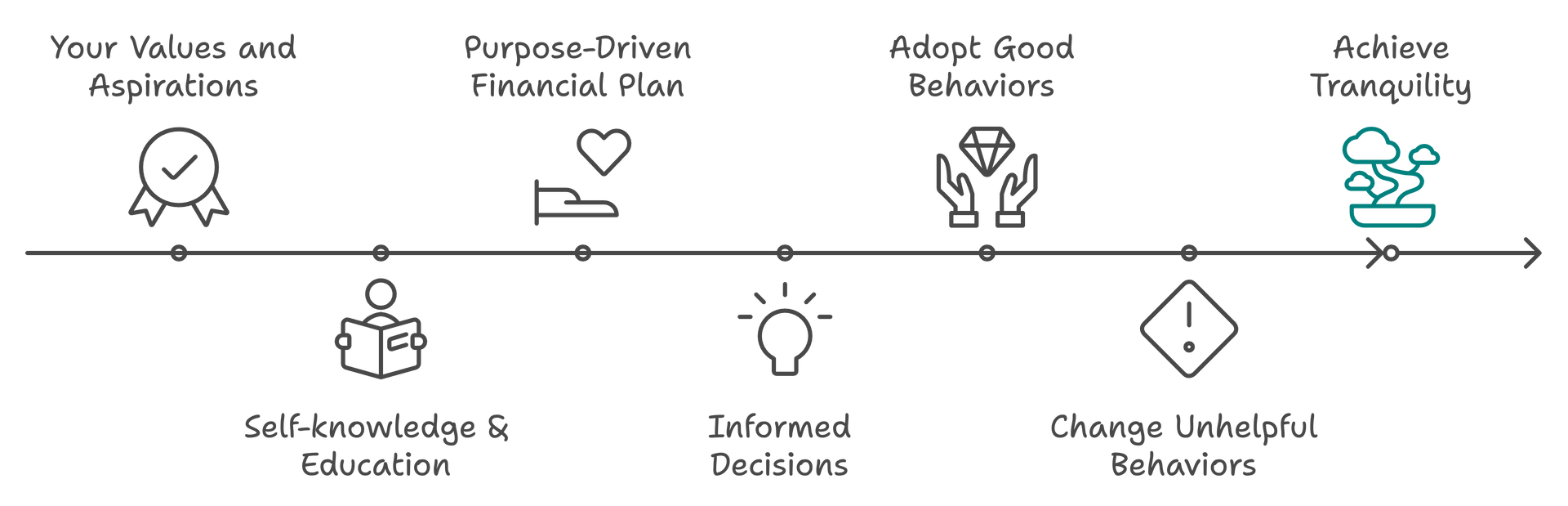

Plan Your Tranquility

Your journey toward tranquility begins with self-knowledge and education. Understanding your values and aspirations is vital for crafting a financial plan that reflects your life purpose. Education empowers you to make informed decisions showing you what behaviors support your financial health and which ones can hold you back.

Financial Planning: A Structured Approach

We tailor your financial plan to align your passions and life purpose with your finances, ensuring a holistic approach to your financial strategy, empowering you to take action and regularly review your choices and life changes.

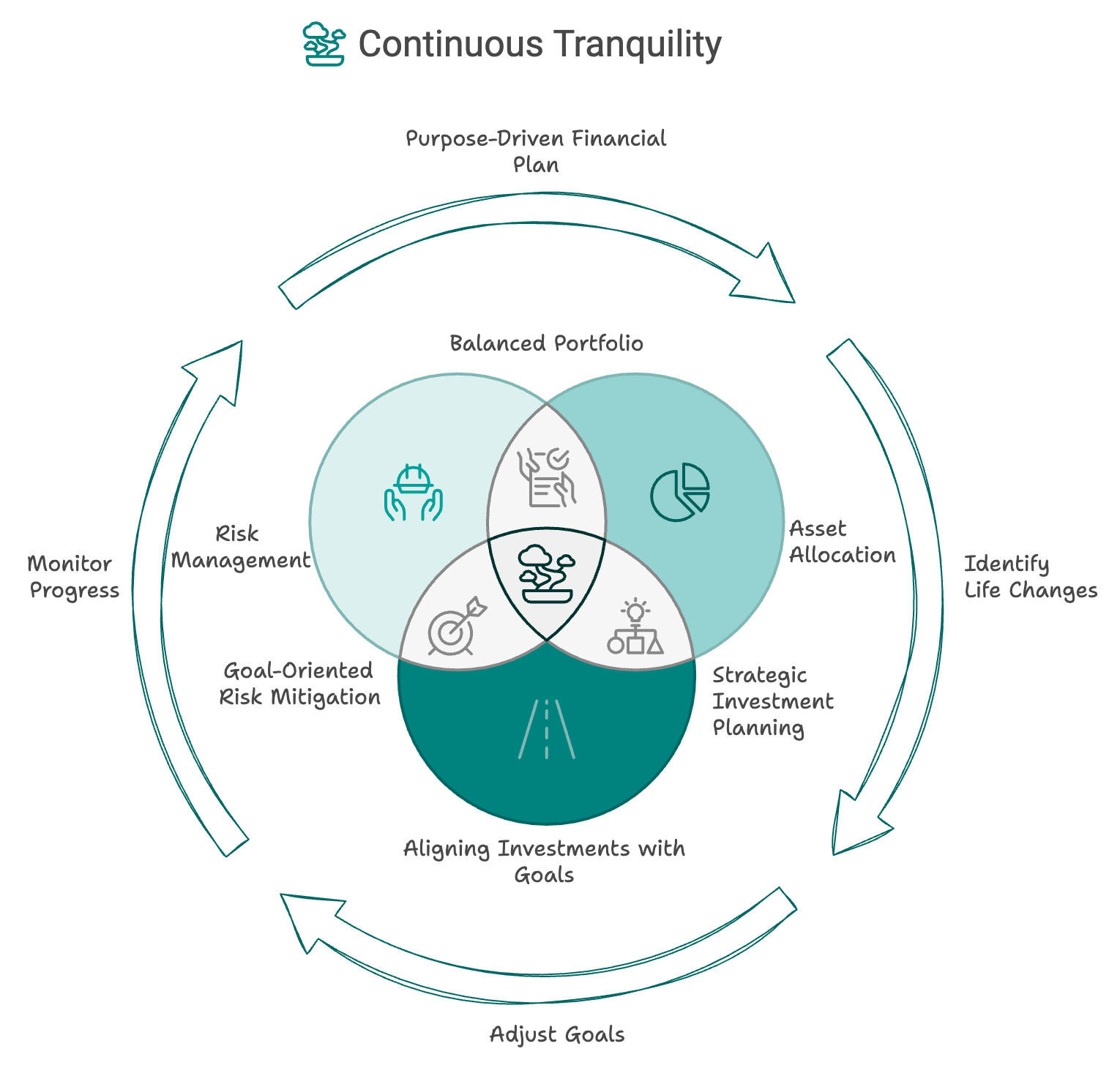

Using the Wealth Allocation Framework (WAF), we address your unique challenges and guide you toward a fulfilling future by focusing on:

- Asset Allocation: Diversifying your investments to mitigate concentration risk. This strategy involves spreading investments across various asset classes.

- Risk Management: Understanding different risk levels —safety (low risk), market (moderate risk), and aspirational (high risk)—is crucial for maintaining a balanced and stable portfolio.

- Aligning Investments with Goals: Creating a timeline for short, medium, and long-term objectives ensures that your investments support both your personal aspirations and financial needs.

Continuous Tranquility with Prospera

Choosing the right financial advisor can significantly enhance your financial well-being by helping you grow and protect your assets while aligning your wealth with your life’s purpose.

At Prospera, we’re dedicated to guiding you through the complexities of financial planning, empowering you to gain the confidence to pursue your life's priorities.

Our mission is to empower you to transform success into

enduring prosperity, grounded in the principles of

mindful stewardship and a frugal approach to wealth. If these values resonate with you, let’s embark on this journey together.