Professional Guidance for Enduring Tranquility

As an entrepreneur, you might be tempted to take a “DIY” approach to financial management. However, managing substantial wealth requires more than just good instincts; it demands professional guidance to prevent costly mistakes and ensure that your financial decisions reflect your values and goals.

The complexities of asset allocation and risk management are best navigated with expertise that goes beyond the capabilities of most individuals. The unique financial challenges faced by tech leaders need specialized knowledge and proficiency.

A qualified advisor can offer tailored strategies to help you grow and protect your assets aiming for your financial well-being.

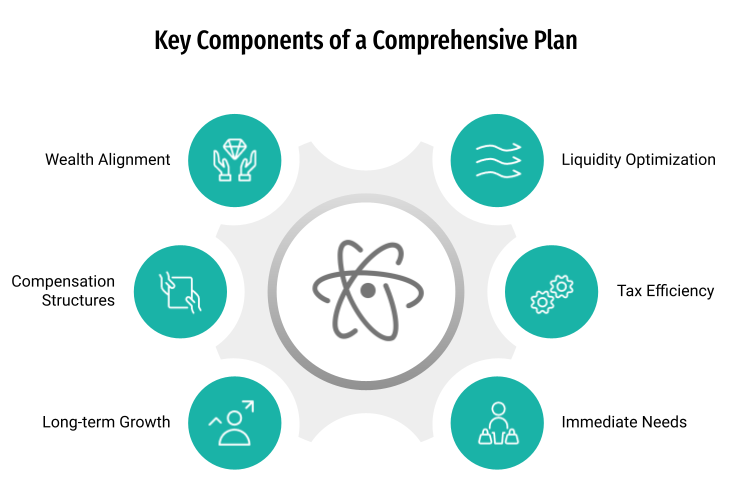

A Comprehensive Financial Plan

An effective financial plan optimizes liquidity and tax efficiency while balancing your immediate needs with long-term growth. This includes navigating the intricacies of compensation structures, such as stock options and RSUs.

In the wake of a financial windfall, skilled advisors can help align your wealth with your life’s purpose—whether that means investing in philanthropy, embarking on new ventures, or enjoying a thoughtfully planned retirement.

The Impact of Choosing the Right Financial Advisor

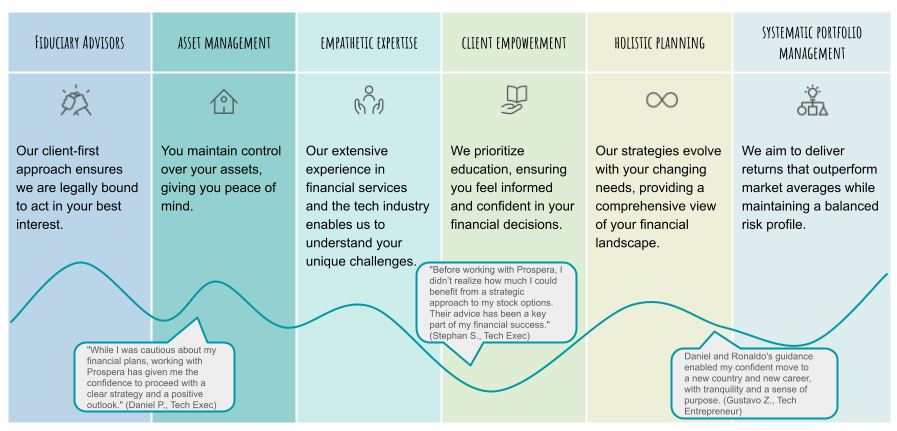

Selecting the right financial advisor can significantly improve your financial journey. At

Prospera, we are committed to transforming financial success into enduring prosperity:

Through a thoughtful approach to wealth, let us guide you on the path to enduring tranquility. Together, we can empower your financial future and help you realize your life’s aspirations.